25 Mar 2013

Right now Australia is having a very ill-informed debate on gas reservation policy.

A new report shows that the best way to manage domestic gas supplies is by letting market forces guide the development and sale of gas.

This report – Domestic Gas Interventions: International Experience – was produced for APPEA by leading consultancy, EnergyQuest. It reviews international experience with government interventions in domestic wholesale gas markets.

The study confirms the benefits of open markets and shows that domestic gas reservation impairs local gas supply and availability.

The EnergyQuest report examines policies in three North American countries in (the US, Canada and Mexico), three European OECD countries (the Netherlands, Norway and the UK) and 14 non-OECD countries (Russia, China, India, Algeria, Egypt, Oman, Qatar, UAE, Indonesia, Malaysia, Thailand, Argentina, Brazil and Peru). Between them these countries produced 74 per cent of the world’s natural gas in 2011.

In March, the new Manufacturing Australia Chair, Sue Morphet, called for the establishment of two gas prices in Australia – one for domestic markets and one for international markets, on the grounds that this occurs in “all other gas-rich countries”. She echoed Dow Chemical and others in saying Manufacturing Australia was simply asking policymakers to do “what the rest of the world does”.

Yet EnergyQuest’s survey of the international landscape shows this is not the case.

The report shows that energy policies primarily reflect whether a country has a free market economy, whether its industry is state-owned, and where it ranks globally in regard to economic development.

OECD countries such as the UK, the Netherlands and Norway – the three significant European gas producers – have a free market for prices and do not impose gas reservation policies. Likewise, Canada and the US have wholesale prices set by the market without government intervention. Indeed, the US shale gas revolution was facilitated by an approach of not interfering with commercial incentives.

Non-OECD gas-producing countries, such Qatar, UAE, Algeria, Russia and Indonesia, intervene in price setting for natural gas to provide subsidised prices. Typically, the industry in these countries is dominated by state-owned gas-producing or gas processing entities, or both.

The EnergyQuest report shows that gas reservation policies actually impair local gas supply and affordability, rather than improve it.

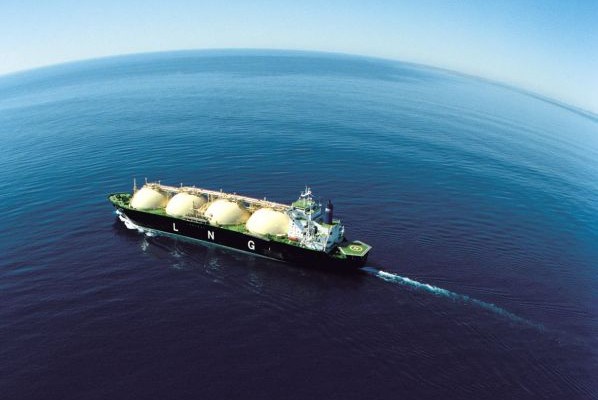

Indonesia now buys domestic gas from its own LNG plants and the UAE imports pipeline gas. In Russia, where state-owned companies dominate the sector and subsidised prices apply to local industry, the government has announced it will increase gas prices for industrial users to export netback parity by 2015.

Laws that dictate where and how gas can be sold invariably deter the very investment needed to develop Australia’s abundant gas reserves.

When we assess the gas reservation policies advocated by some companies and interest groups, we see that they represent a return to protectionist policies that Australia abandoned in the 1980s.

In an advanced economy underpinned by competitive markets, such as Australia, one industry should not be required to subsidise the activities of another.

The best policy response to rising prices lies in bringing more gas to market – by reducing the green and red tape currently constraining new projects, rather than intervening through a domestic reservation policy.

APPEA has long maintained that arguments for gas reservation are short-sighted and self-interested. Whether the commodity in question is gas, iron ore, wheat or anything else, access to open and competitive markets is in Australia’s best interests.

Domestic Gas Interventions: International Experience can be downloaded here.